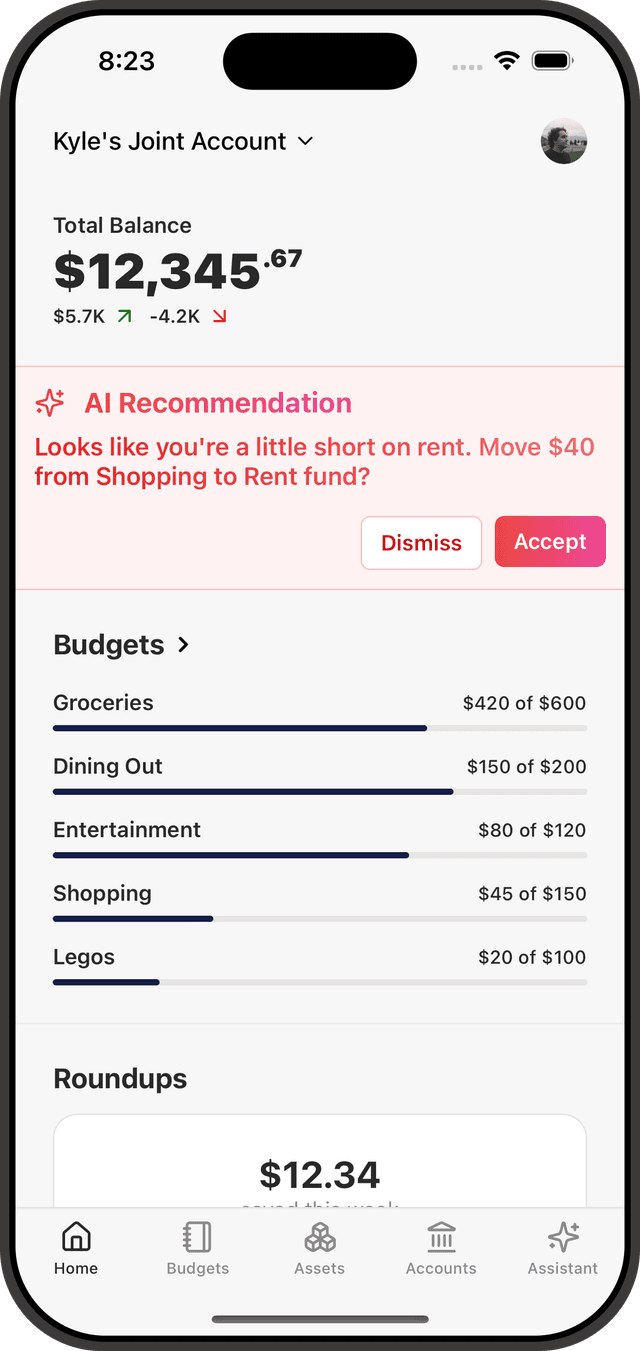

Your bank account, built for real life

Ditch the spreadsheets. Sediment is the first bank account built to automatically budget, save, and plan — for you.

Not just a bank. Not just a budgeting app.

Most apps only solve part of the problem. Sediment is the first to bring your bank and budget together.

Bank Apps

Show you a single balance.

No budgets, no planning.

Bills hit randomly — you hope it's enough.

Budgeting Apps

Show charts after you've spent.

Can't block overspending.

Can only read data from your bank, can't help you enforce

Sediment

Budgets that enforce (warn or block).

Bill-specific savings with automation.

AI assistant that acts for you.

Your bank + your budget, finally in one place.

Structured Checking

Set budgets within your checking account by category. Choose between soft budgets that warn you when you're over budget and hard budgets that decline transactions exceeding your set limit. Enjoy real-time balance updates per category and flexible budget intervals.

Asset-linked Savings

Link savings accounts to real-world assets like vehicles, homes, and more. Access specialized features including document storage, payment forecasts, maintenance tracking, event reminders, and asset lifecycle planning.

AI Assistant

Get intelligent, context-aware support throughout your experience. Beyond answering questions about budgeting and savings strategies, our AI can help you set up accounts, move money, adjust budgets, and proactively suggest actions based on your behavior.